Email faker steals $30,000 from family trying to buy a home

BY KERRY TOMLINSON, AMPYX NEWS

One missing letter in an email address turned into a $30,000 scam for a Florida family.

Cyber crooks stole all the money they had saved for the down payment for a new house through a series of fake emails and impersonations.

The family is now urging people to stay alert when making a large payment or buying a home.

Watch here:

Dream home

This was going to be a big year for Matthew and Stefanie Brock.

They had saved up their money, welcomed a new baby, and found a house for him to grow up in, not too far from their family-run restaurant in Lake Wales, Florida, about an hour south of Orlando.

"Just something was right. Like, you know how a puzzle piece will fit perfectly? This house did that for us," Matthew said.

They made an offer and the sellers agreed. On January 8, they sent off the down payment, more than $38,000. The next day, they headed out to sign the final documents in person.

"We're sitting in the parking lot, we get a phone call from the trust company saying that the funds haven't arrived yet," Matthew recalled in an interview with Ampyx News. "We're on our way to the signing. We're on our way to closing."

"Stefanie's like, 'What do you mean the funds haven't arrived? You know, I sent them yesterday,'" Matthew added.

Missing Money

The down payment had disappeared, not into the seller's account, but into the account of thieves impersonating the real estate law firm in a complex email scheme.

"I was in disbelief. I thought, 'No, you need to double check,'" Stefanie said. "It's there somewhere. That money is not gone."

But it was. And with it, their hopes to buy the house they loved.

"I could literally feel, like, blood draining from my body," Stefanie said. "There were no words."

Imposters in the mix

The Brocks started to unravel the trickery to find out how the cyber crooks infiltrated their conversations.

"They played the long game," Stefanie said. "They were in there for quite some time playing the middleman."

This kind of attack can start with thieves hacking into your email, according to cybersecurity experts. The attackers may guess your password or trick you into clicking a link in a fake Microsoft email. Once inside, they look for things like real estate transactions.

"They're patient," said Pete Nicoletti, global CISO for the Americas at cybersecurity firm Check Point, in an interview at the 2025 RSA cybersecurity conference in San Francisco. "They start reading your emails and they're using artificial intelligence tools to analyze what is valuable to this person."

"They look at your folders," he added. "There's my financial folder, there's my Bank of America folder, here's my communications back and forth."

They can insert themselves into the email conversation, deleting emails from the other people involved and sending their own messages to control the transaction.

The Brocks' case

Lake Wales police did not find evidence that the crooks hacked into the Brocks' email accounts. But the scammers did find a way to impersonate the family, according to Detective Riley Helgerman.

They made look-alike accounts that were the same email address as the Brocks, but with an extra character.

"So, it was my email, plus one more number," Stefanie explained.

They did the same with Stefanie's father, who was helping with the purchase. They also made a fake email for the real estate law firm, just one letter off.

"They actually used the same email address as Nasseh Law," said Detective Helgerman. "The difference is, at the very end of the email, instead of ‘dot-com,’ it was ‘dot-co.’ So, it's very easy to overlook."

Stefanie said she simply thought the full email address was not visible on her screen.

"When you're reading this long, massive email chain, those things get cut off at the very end. So, I didn't think anything of it," she said.

Setting up the scam

The thieves wrote back and forth with the false accounts for days, the fake family speaking to the real law firm, the fake law firm speaking with the real family.

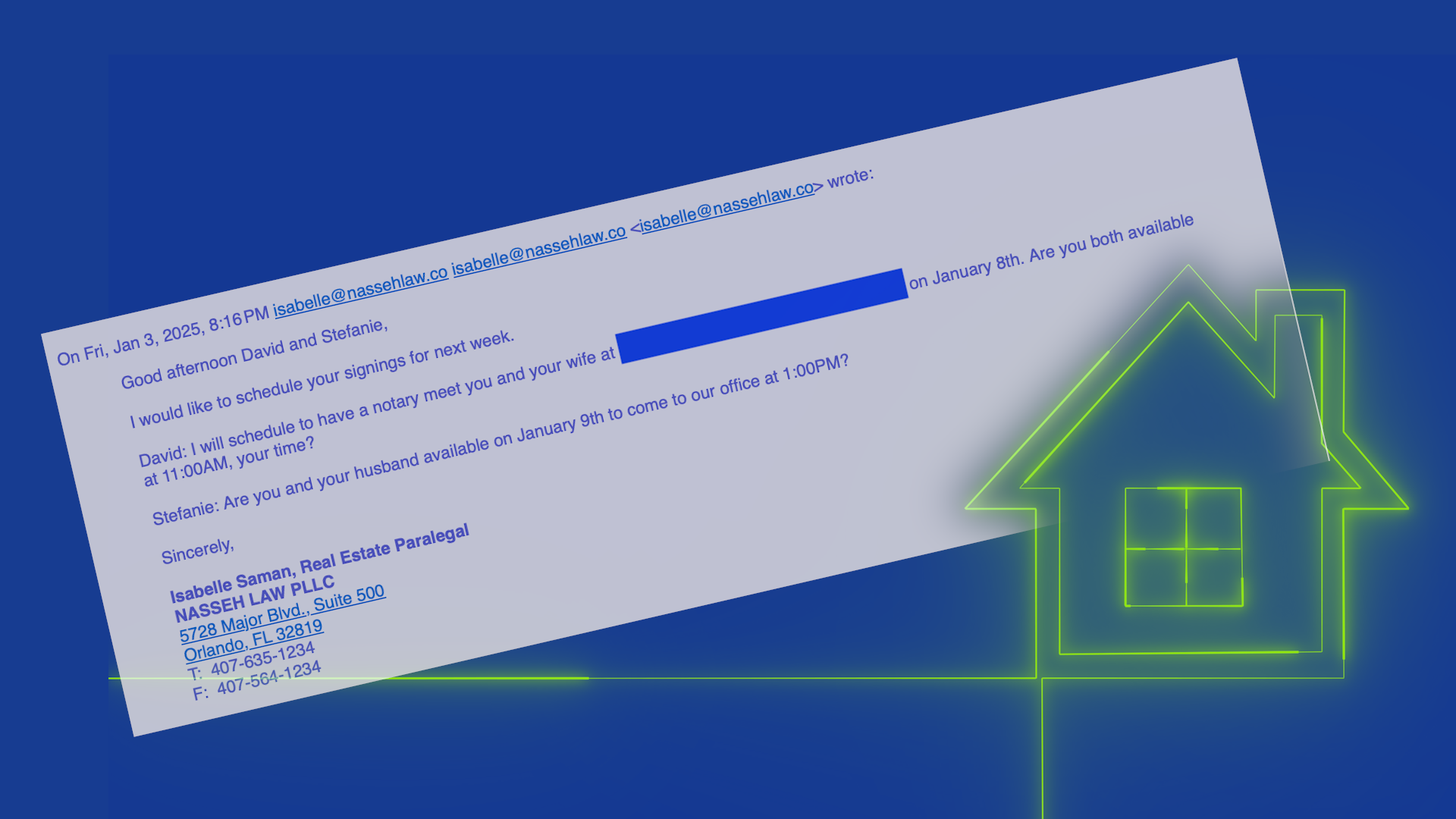

On January 3, the thieves sent an email to the Brocks, posing as Isabelle of Nasseh Law.

"I would like to schedule your signings for next week," it read. "Stefanie: are you and your husband available on January 9 to come to our office at 1 pm?"

Stefanie continued the conversation with the faker three days later, asking for the down payment wiring instructions. She referenced a phone call with the real law firm.

"When we spoke on the phone this afternoon you said you would be sending the email with information on where and how to send funds for closing today," her mail read.

The scammers intercepted the real wiring instructions, made changes to the document, and sent it through on January 7 from the fake law firm account.

They added in their own bank account number. They also removed the real estate law firm's warning to not trust wiring instructions by email and always call verbally to confirm.

The next day, the family sent off the money to the account number in the wiring instructions they received.

It was the scammer's account. The money was quickly withdrawn.

"This was not 'stabbed in the back,'" said Matthew. "This was a clean swipe with a sword, through our hearts and our souls."

Forensic audit

The real estate law firm told Ampyx News that they did a forensic audit and found no trace of an email hack on their end.

"Our firm provides multiple written disclosures and verbal warnings advising clients never to rely solely on emailed wire instructions and to always call and verify before sending funds," Nasseh Law said in a statement.

The firm said it also asks clients to sign documents agreeing to confirm wiring instructions before paying.

They said they deeply sympathize with the victims of this kind of fraud.

"We never send last-minute changes to our wire instructions, and we urge all parties in a transaction to remain vigilant," Nasseh Law said.

What to do

The Brocks have advice for anyone who may be buying a house.

"Slow down. Read everything that you're getting," Stefanie recommended. "Always confirm, confirm, confirm everything before you send that much money."

Stefanie said she did call to verify the account number for an earlier payment.

"I did previously call them for the escrow," she said. "So, I did confirm that one. But because I had already done it, I didn't think to go back and do it again."

And with the warning on confirming wiring instructions removed, she unknowingly delivered $38,805.17 to the thieves.

In the crush of emails during the purchase process, from insurance to inspections to escrow, the Brocks did not notice anything out of place.

"You're also receiving so many different emails from so many different people," Stefanie said. "There was just so much coming in all at the same time, and I had never purchased a house before, so me, personally, I didn't know that anything was off."

Small clues

Looking back, Matthew remembers missing emails during their discussions with the real estate attorneys.

"The fact that these emails were dropped. Like, 'I sent you this email, you didn't get it?' If that stuff happens, put a magnifying glass on all everything you're sending out or receiving," Matthew advised.

Cyber crooks often make very subtle changes to email addresses to imitate you or someone you're working with, said Detective Helgerman.

"They'll change a letter. Or if there's a letter 'O' in the in the name, they'll change it to a zero," he said.

"It's very difficult to detect things like that," he added. "That's why we just need to comb over the emails that we're getting. Try and find some type of discrepancy in them, especially when it's a large transaction, something that could be life changing."

Starting over

The Brocks are rebuilding their lives. They managed to get back $5,000 from the scammer's account before it was too late. They turned to family and the community to scrape together enough to buy the house.

In the end, they got their home. They hope you'll remember their story when you need to make a big payment in the future.

"A lot of people, I believe, don't want to tell this story," Matthew said. "You feel ashamed that it's happened to you."

"I really, truly feel if I help one person," he said, "they double, triple check the stuff that they're doing whenever they're doing something like this, and they find something and it saves them, then it's a big win for me."

Growing scam

One in four homebuyers surveyed said they received suspicious or fraudulent communications during the process, according to a 2025 report by CertifID, a real estate wire fraud security company.

About one in 20 homebuyers reported falling victim to wire fraud, the report said. Eighteen percent of victims said they didn't find out about the fraud until they showed up for closing. First-time homebuyers are three times more likely to fall victim, but people with experience are also defrauded.

Here is the Brock's advice:

Slow down

Read everything

Watch for anything that seems off

Check email addresses carefully

Confirm account numbers always

You can find more help at:

National Association of Realtors: Protect your money from mortgage closing scams

HousingWire: How title companies are combating wire fraud

National Reverse Mortgage Lenders Association: Protecting your clients from wire fraud

ALSO IN THE NEWS:

Fake leather, fake people: AI sellers generate numerous complaints

Fake authors are swindling people with shady AI travel guides